This article originally appeared on LinkedIn.

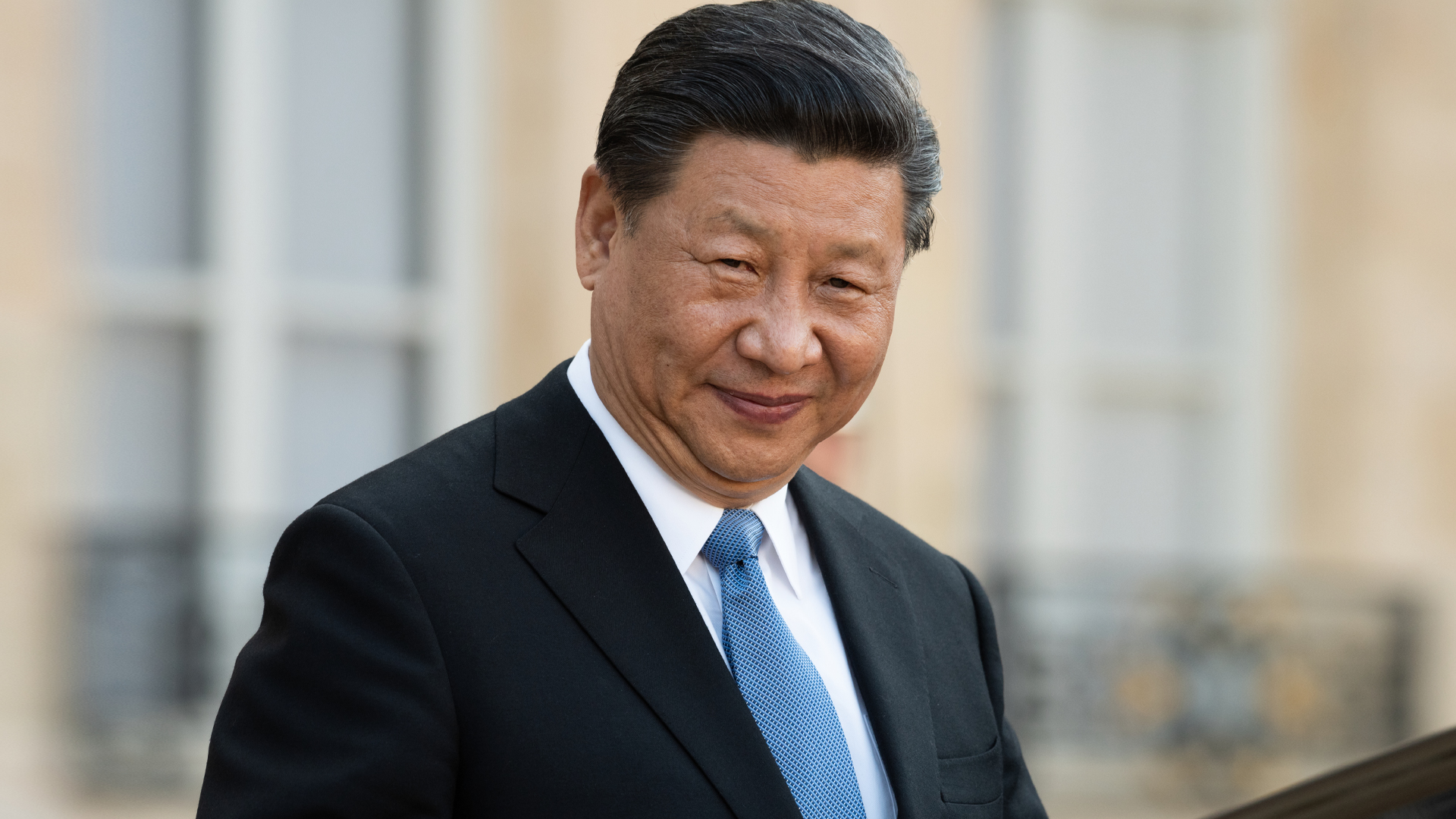

China’s President Xi Jinping has swooped into the UAE for three days providing a “blueprint” of how to build up government relations in the UAE. The hard work is done in advance of the trip. Relations have been developed through delivering projects not meetings. Ties with hard-to-reach leaders are developed through projects that resonate, locally driven by indigenous policy needs. If you want the back-story, read on….

First, Chinese tech companies have been ‘moving mountains’ the previous several months to deliver projects, translating their UAE business ties into a concrete presence on the ground long before this trip.

China’s answer to eBay and Amazon, the $500bn Alibaba, quietly started the region’s largest high tech investment project last year to co-build a $600m Chinese Tech Town in Dubai, housing 3,000 Chinese high tech companies in a space five times larger than the Pentagon. The Chinese are creating the UAE’s only Chinese radio station for the 200,000 Chinese people and 4,200 Chinese businesses in the country.

And the Chinese deliver: building a new massive commercial hub on a vast patch of desert, Dragon Mart II, as it is known, about the size of Grand Central Station, was opened by the UAE Prime Minister. Dragon Mart II is slated to host scores of Chinese cultural festivals and house thousands of Chinese businesses. China is playing the long-game.

Second, China built up ties through projects that create interdependencies between itself and the UAE government, not just VIP meetings. China’s answer to Samsung, Xiaomi, has rolled out a 1,500 square feet stores in Dubai or to put that in context, about the size of 3 basketball courts, while Beijing granted the Middle East competitor to Amazon, UAE-based e-Commerce giant Noon with approval to expand into China’s booming e-commerce market. Amazon stated “in order to meet local ownership and regulatory licensing requirements, www.amazon.cn is operated by PRC companies that are indirectly owned, either wholly or partially, by PRC nationals.”

Third, China’s president followed a GR plan shaped by UAE local realities. He chose to open his trip in Abu Dhabi, the capital, which has over 87% of the country’s oil and over 90% of its territory, while many leaders (from companies and governments) often only go to Dubai. But expanding ties with Dubai and expecting it to obtain political weight in Abu Dhabi would be almost like building up ties with Los Angeles and expecting it to produce political weight in Washington DC. They are different. Abu Dhabi and Dubai have their own unique identities and President Xi has spent time in both.

The UAE’s knowledge economy plans are creating a significant opening for Chinese tech companies to rapidly expand their presence in the Middle East high tech sector, as their American counterparts often haven’t met local expectations of how much they’d deliver. Huawei has built the broadband networks in a growing number of Emirati and Saudi cricles, and then runs the networks of numerous local Emirati state-backed entities. The Chinese tech titan is now playing an emerging role in Dubai’s Smart City program, while Alibaba is also building its second major data center in the UAE with a Dubai Holding JV.

Simply put, China is rewriting the rules on how to rise in influence in the Middle East. President Xi is displaying world-champion, grandmaster multitasking moves in reshaping Chinese ties with the Arab world. Aligned to Beijing’s new “Go West” strategy, he is “aiming high, and working backwards” re-allocating the PRC’s vast wealth toward building the most extensive modern infrastructure system in history, linking four continents. President Xi is reinvigorating the ancient Silk Road and developing its new sea-equivalent. And because of the UAE’s goliath-sized ports and geographic position sandwiched between Saudi Arabia to its West and Iranian waters to its East, China and the UAE are thinking at-scale of how to jointly contribute to both Silk Road routes.

A global tech giant that few might have heard of, Tencent, larger than Facebook by market cap, cemented a deal with Dubai Tourism and Commercial Marketing to jointly pursue the 1m Chinese visitors per year coming to the UAE. The Dubai Visitor Economy is built on attracting people from abroad like China and China has a lot of them. Many American tech companies’ MENA offices may have grown comfortable with their regional reputation and still think that Chinese tech platforms are of lower quality. But U.S. companies shouldn’t dismiss them. As the old Arabic proverb says: “the rain begins with a single drop.”

Chinese tech titans have been making big bets on mobile internet, cloud computing, and O2O (online to offline) in the Middle East. Chinese companies comprise half of the top 10 e-business companies in the Middle East and have created more than 5,000 jobs in Arab countries. Beijing-backed companies invested $1bn to build out Abu Dhabi’s Sheikh Khalifa Port.

The Chinese President showed that MENA government relations is “a contact sport.” He spent a full three days in the UAE. The “fly-in, fly-out” model is not as effective anymore. You have to “roll up your sleeves” and put the time in. In contrast to engaging, U.S. President Trump seems to adopt a de-facto “withdrawal doctrine” withdrawing from the Iran Nuclear Deal, the Paris Climate Accord and consistently flirting with withdrawing from Syria, and the World Trade Organization.

China also has 731m internet users as of 2017, more than the E.U. and U.S. combined. And don’t underestimate China. By 2022, its economy is projected to be 78% the size of that of the United States. And China’s three largest internet companies have made 35 overseas deals in the past two years alone, compared with 20 by the top three American internet companies. American companies looking to expand in MENA should track this.

Several Chinese tech companies have proven that they are more comfortable working with Arab governments than their American counterparts in meeting their security-surveillance requirements and not raising those pesky U.S. privacy laws. Chinese technology companies don’t bring a track record of (unintentionally) facilitating ISIS and regime criticism. They are not idealogical. They have shed their old Communist image. There are more people in the Bay Area now, where I’m from, who believe in Marxist-Leninist theory than in Beijing.

The results speak for themselves. The Emirati leadership welcomed the Chinese President with a 21-gun salute, bestowing him with the UAE’s highest civilian award, the Order of Zayed, which the UAE has only awarded to the Queen of England, Saudi’s King Salman and Morocco’s King Mohammed VI.

For context, China is still a smaller, more marginal geopolitical player in the Gulf than the U.S. or Russia. In military terms, Beijing was almost mute in the 2003 Iraq War against one of its then-largest oil suppliers, voted for sanctions against Iran another one of China’s major oil suppliers. Nonetheless, China’s regional influence is mushrooming. Chinese companies have built a local footprint in all seven emirates, and their government affairs leads are quite adept at “clearing the path” for them. Their country has become the single largest foreign investor in the Middle East at $29.5bn in 2016 and Chinese companies are following in Xi’s path building out global businesses in the UAE, rather than just shipping products from China.

The prize is significant. With over 330m people, the Middle East has become about the size of the U.S. population-wise. The UAE has become the center of gravity in that Arab ICT policy world. It assembles Arab government positions on ICT laws, conventions, and organizes a cross-border enforcement positions while also training other Arab ICT regulators. Nearly every Western and Asian tech giant place their MENA HQs in Dubai. A small country younger than Matt Damon, the UAE has over 98 incubators and accelerators, more than London has now.

The Way Ahead

The UAE tech sector will ultimately be built by someone. And that someone will be either a tech company from the West or from China. Most Arab governments are not waiting around for the U.S., while flirting with a Chinese-style approach to walling off large swaths of the web. Nearly every large Chinese tech company is cementing long-term ties with the UAE tech sector, looking at the Emirates as a hub for finance and technology investments, not simply a customer for ads, marketing, and users.

Read article on LinkedIn.